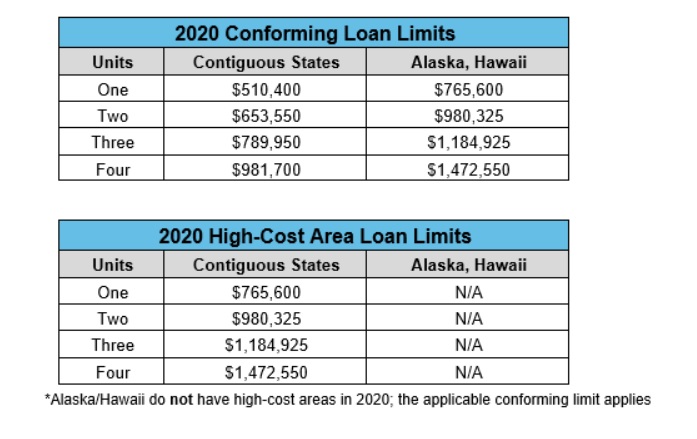

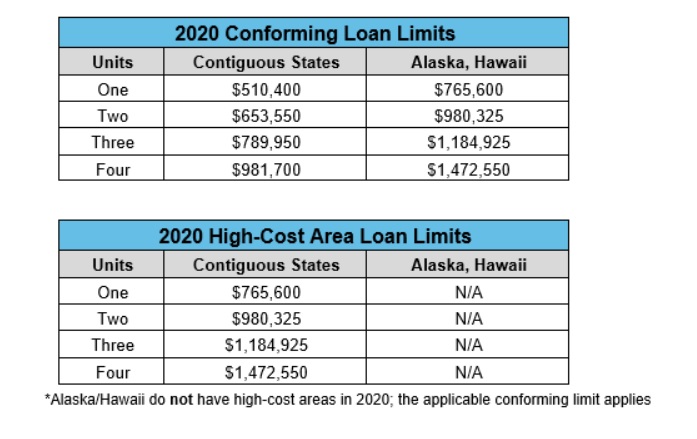

The Federal Housing Finance Agency (FHFA) has announced 2020 loan limits for FNMA and FHLMC agency loans.

The complete list of counties (including high-cost area counties) can be found via this link: Federal Housing Finance Agency.

REMN limits the maximum loan amount on Freddie Mac transactions to $1,000,000 regardless of the number of units.

**NOTE** Alaska and Hawaii high-cost limits have not been implemented by FHFA, which means loan limits in these states must conform to the general loan limits.

If the loan is a high balance/super conforming loan, it is important to check the loan limit for the property address county as loan limits may be lower than the amount identified in the table above.

The 2020 loan limits may be applied to new submissions and to loans currently in the pipeline. Loans may receive an “Approve/Ineligible” or “Accept/Ineligible” finding however REMN will accept if the only ineligible reason is due to the loan amount exceeding the 2019 limit.

2020 loan limits will be incorporated into DU the weekend of December 7, 2019. Freddie Mac has not provided a specific date for LP incorporation other than it will occur in early December.

REMN will update Fannie Mae and Freddie Mac guidelines with these new limits in our December guideline release.

If you have any questions, please contact your Account Executive.