SUBJECT: Updates to FHA Mortgage Insurance Premium

DATE: February 28, 2023

FHA published Mortgage Letter 23-05 announcing Mortgage Insurance Premium reductions effective for case numbers with an ENDORSMENT date of March 20, 2023, and after.

REMN Wholesale will begin applying the lower MIP amounts to existing pipeline loans March 1, 2023 (any loan that has not been scheduled to close or had closing docs out). The lower MIP amounts will appear on the final CD or the initial CD, if one hasn’t already been generated. In addition, the new MIP amounts will be applied to loans submitted for REMN-prepared initial disclosures and loans submitted to Setup March 1, 2023, and later. There is no action required from our business partners. Brokers will continue to see current MIP amounts in the Hub, until the new MIP amounts have been programmed.

Overview

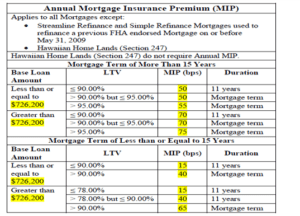

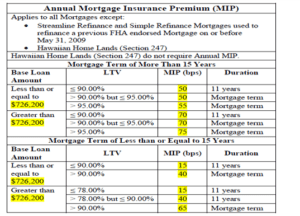

- The change is for the ANNUAL premium for all loans except Streamline Refinances, Simple Refinances, and Hawaiian Home Loan (Section #247). Hawaiian Home Loans do not require an annual MIP

- Streamline and Simple Refinance loans’ annual premiums are not subject to the reduced premium and are unchanged

- The upfront MIP is also unchanged