SUBJECT: New IRS 4506C Form

DATE: February 28, 2023

The IRS is implementing a new version of the 4506-C – Form 4506-C, IVES Request for Transcript of Tax Return along with new requirements for form completion. These changes are required to support the IRS’ implementation Optical Character Recognition software.

Effective March 1, 2023, the Internal Revenue Service will only be accepting transcript requests completed on the new 4506-C form.

4506-C Form

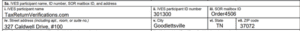

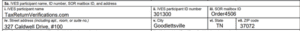

The REMN IVES participant information must be included on Line 5a, in its entirety, as shown below or the transcript request cannot be processed.

In addition, the Client information must be completely filled out in section 5d.

Broker Transactions

REMN Wholesale is including the new version of the 4506-C form for both REMN-prepared initial disclosures and when re-disclosing to the borrower(s) for Broker-prepared initial disclosures.

Emerging Banker Transactions

A fillable PDF version of the 4506-C form with REMN’s IVES information completed is available at www.remnwholesale.com under the Forms section. Emerging Bankers may use this form for the borrower(s) to execute.

For all Broker and Emerging Banker transactions, if the 4506-C form needs to be updated during the loan transaction, REMN will provide the corrected form to the client to have the borrower(s) sign.

NOTE: Broker or EB provided tax transcripts may not be used. Obtaining tax transcripts must be facilitated by REMN Wholesale.

** Please contact your Account Executive with any questions**