REMN Wholesale is pleased to announce that effective Monday, June 12, 2017 we will be offering Freddie Mac’s Home Possible and Home Possible Advantage programs.

Home Possible/Home Possible Advantage are affordable lending programs designed for first-time homebuyers, move-up borrowers, retirees, very low and low-to-moderate income borrowers and borrowers in underserved areas.

Income Requirements

Property is Not Located in an Underserved Area

The Home Possible programs have the following income requirements for properties not located in an underserved area:

- The borrower’s total annual income cannot exceed 100% of the area median income (AMI), or

- If the property is in a designated high-cost area the borrower’s total annual income cannot exceed 100% of the AMI plus the high-cost area multiplier applied by Freddie Mac (multiplier varies by property location). To view income multipliers by state/county, click here: Income Multipliers High-Cost Areas

Property is Located in an Underserved Area

- If the property is located in an underserved area there is no income limit applied

Determining Income Eligibility

There are two options available to determine income eligibility based on the property location.

- Loan Product Advisor will indicate income eligibility, or

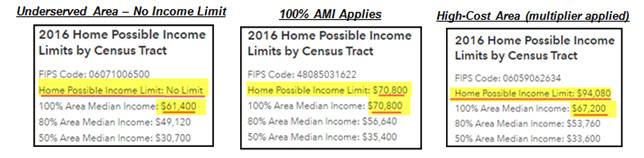

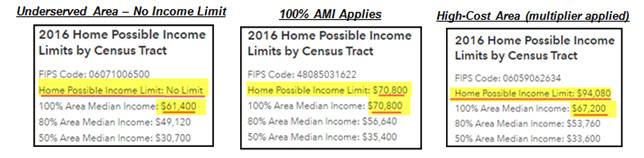

- The complete subject property address may be entered into Freddie Mac’s Home Possible Income & Property Eligibility The Eligibility tool will indicate if no income limit applies, or the Home Possible income limit based on 100% AMI or, 100% AMI plus high-cost area multiplier:

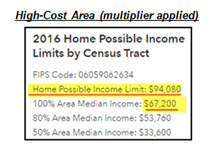

High-Cost Area (multiplier applied) Example:

In the Home Possible income limit for a high-cost area example above the property is located in CA. Freddie Mac applies an income multiplier of 140% to all CA counties.

- 100% Area Median Income for this property is $67,200

- $67,200 multiplied by 1.4 (140%) = $94,080

- The Home Possible income limit for this property is $94,080 (140% of the AMI). In this example the income limit is higher than 100% of the AMI.

Reminder: Manual calculation is not required; the Home Possible Eligibility tool and LPA will provide the applicable multiplier for the high cost area as reflected in the High-Cost Area (multiplier applied) example above.

Highlights of the Home Possible programs include:

- Purchase and rate/term transactions

- Conforming loan amounts only; super conforming ineligible

- LPA “Accept” required; manual underwrite ineligible

- 1-4 unit primary residence 95% LTV/CLTV (Home Possible). Standard secondary financing options eligible.

- 1-unit primary residence 97% LTV/105% CLTV (Home Possible Advantage). Secondary financing must be provided by an Affordable Second program

- 97% LTV for a refinance transaction does not require the loan being refinanced to currently be owned by Freddie Mac

- No borrower own funds requirement on 1-unit properties

- 2-4 unit properties require 3% borrower own funds

- DTI per LP

- Reserves not required on 1-unit properties; 2 months reserves required on 2-4 unit properties

- Lower MI coverage at 90.01% to 97% LTV: 25% (standard coverage requires 30% to 35%)

- Rental income (aka boarder income) eligible on 1-unit properties

- Non-occupant co-borrowers not allowed

- Homeownership counseling only required if all borrowers are first time homebuyers

- Landlord counseling required for 2-4 unit purchase transactions

- Cash-on-hand eligible for 1-4 unit properties; eligible for down payment, closing and financing costs, prepaids, escrows and reserves

- Manufactured home eligible using Home Possible; manufactured ineligible using Home Possible Advantage

- Borrower cannot have an ownership interest in any other property (see guides for exceptions)

The REMN Wholesale rate sheet will reflect Home Possible pricing effective June 12, 2017.

If you have any questions, please contact your Account Executive.