Subject: FNMA RefiNow™ Product

Date: June 24, 2021

REMN Wholesale is pleased to announce we have added FNMA’s RefiNow™ to our product roster.

Product Highlights

- The existing loan must be owned by Fannie Mae – and can be identified by using the Fannie Mae Loan Lookup Tool

- The borrowers on the current loan must be the same on the new loan

- No new borrowers can be added

- One or more borrower(s) may be deleted if the following applies:

- The remaining borrower(s) have a payment history of 0x30 in prior 6 months and no more than 1×30 in months 7-2), and

- The remaining borrower(s) provide evidence that they have made the mortgage payments from their own funds from the prior 12 months, OR

- The borrower being removed is deceased and documentation is provided

- The borrower’s qualifying income (income from all borrowers who will sign the Note) must be ≤ 80% of the Fannie Mae 2021 AMI limit for the area where the property is located.

- The refinanced loan must provide the following borrower benefits:

- A reduction in the interest rate of at least 50 basis points, AND

- A reduction in the borrower’s monthly payment, that includes the principal, interest, and mortgage insurance payment (if applicable), by a minimum of $50

- Fannie Mae will provide a $500 credit If an appraisal is required.

Product Eligibility

- Primary residence only

- 1-unit only

- Conforming loan amounts only

- Rate/term refinance only

- Max LTV 97% (95% for Manufactured Homes and loans with Non-Occupying Co-Borrowers)

- Max DTI 65%

- Minimum FICO 620

- Max cash back to borrower $250

- Max $5000 in closing costs can be included in new loan

- Payment history on the existing loan requires 0x30 for the most recent 6 months and no more than 1×30 in months 7-12. If the borrower was in a COVID-19 related forbearance plan and the missed payments have been resolved, they are not considered in the above as a delinquency

- Funds to close must be verified

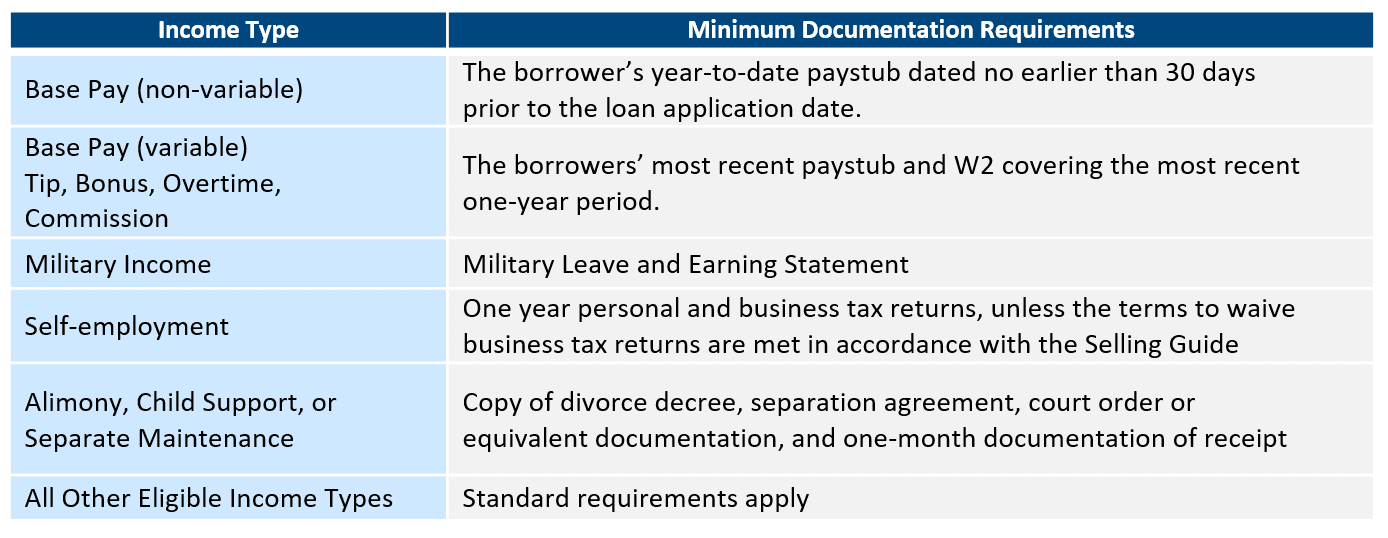

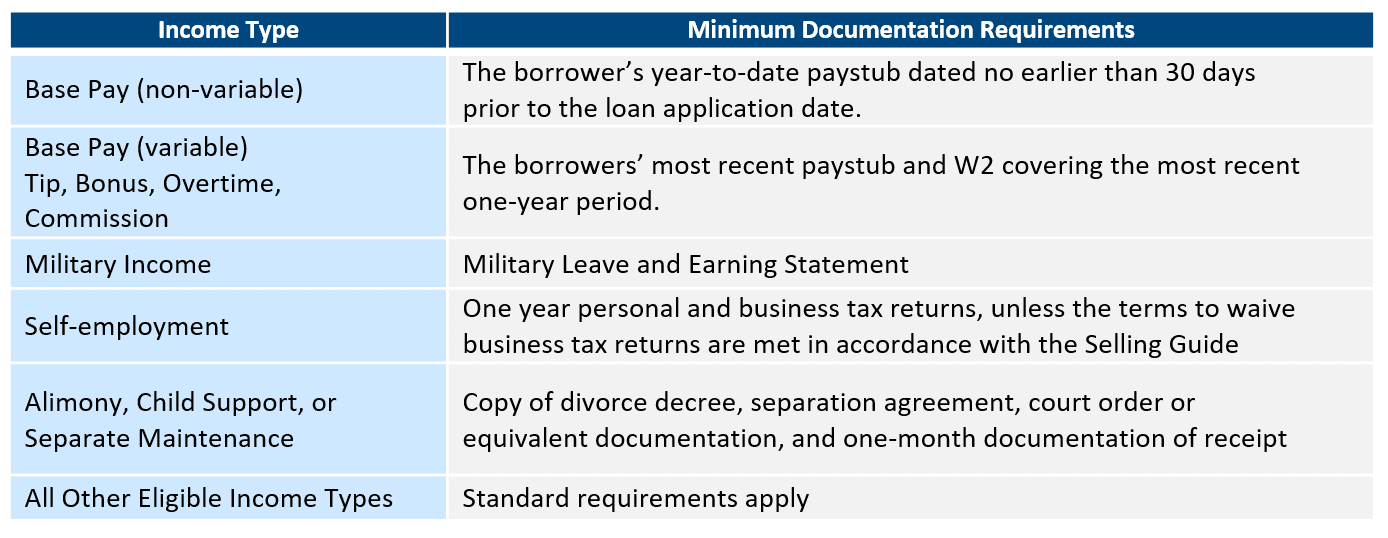

- Income documentation requirements

Desktop Underwriter

- Desktop Underwriter identifies RefiNow™ eligibility per the below:

- If the file is a 1-unit primary residence limited cash-out, AND

- If the income in the casefile is at or below 80% of the AMI, THEN

- DU will determine if Fannie Mae owns the loan, using the subject property address provided on the loan application

- If DU determines FNMA owns the loan and the SSNs are a match, DU will underwrite the loan as a RefiNow™

- If none of the SSNs match, DU will issue a message to validate the property address

- If SSN discrepancies are found, DU will issue specific messaging for requirements

Full product guidelines can be found at www.remnwholesale.com

To access a PDF version of this announcement click here.

If you have any questions, please contact your Account Executive.